Understanding rental yields is vital when considering a second property in Singapore. Factors like location (CBD vs. suburbs), market trends, property age, and government policies impact yields. To calculate potential income, assess property size, comparable rents, and occupancy rates. Staying informed about market fluctuations helps time purchases optimally. Successful investments are found in diverse areas with high demand and strategic updates, while navigating regulations is crucial for foreign investors.

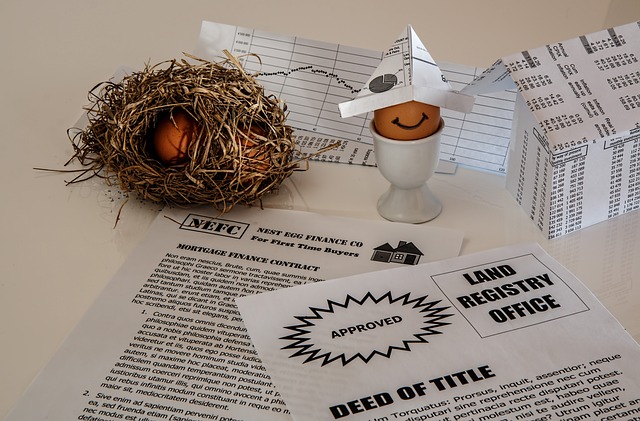

Considering a second property investment in Singapore? Understanding rental yields is crucial. This comprehensive guide breaks down key metrics, market influences, and step-by-step calculations to help you navigate the vibrant but competitive landscape. We explore trends, successful case studies, legal considerations for foreign investors, and strategies to maximize yield and property value. Dive into this essential resource for informed decision-making when buying a second home in Singapore.

- Understanding Rental Yields: A Key Metric for Investors

- Factors Influencing Rental Rates in Singapore's Property Market

- Calculating Potential Rental Income: A Step-by-Step Guide

- Analyzing Market Trends: When to Buy and When to Wait

- Case Studies: Successful Second Home Investments in Singapore

- Legal and Financial Considerations for Foreign Investors

- Strategies for Maximizing Rental Yield and Property Value

Understanding Rental Yields: A Key Metric for Investors

Understanding Rental yields is paramount for anyone considering Investing in a second property in Singapore. This key metric represents the annual return on investment generated from rental income, typically calculated as a percentage of the property’s purchase price.

For investors, it serves as a critical indicator of a property’s profitability. Higher rental yields suggest more lucrative returns, making them attractive for those looking to diversify their portfolios or generate passive income. When evaluating buying options for a second property in Singapore, understanding local market trends and comparing yields across different areas is essential to make informed financial decisions.

Factors Influencing Rental Rates in Singapore's Property Market

In Singapore, various factors significantly influence rental rates in the property market, especially for those considering Buying Second Property In Singapore. Location is a key determinant; prime areas like the Central Business District (CBD) or popular neighborhoods near schools and transportation hubs command higher rents due to their convenience and high demand. The property’s age, size, and condition also play a crucial role; newer buildings with modern amenities generally attract higher rental yields. Market dynamics, such as population growth, employment rates, and migration patterns, drive demand, impacting rental prices.

Government policies and incentives can also factor into rental yields for Buying Second Property In Singapore. Tax breaks, grants, or regulations affecting landlords’ profits can influence investment decisions. The competition from other property types, including private apartments, HDB flats, and commercial spaces, is another aspect to consider. Understanding these factors helps prospective investors make informed decisions when evaluating rental potential in Singapore’s dynamic market.

Calculating Potential Rental Income: A Step-by-Step Guide

To calculate potential rental income for a second property in Singapore, start by assessing the property’s size and its location. Factors like neighbourhood desirability, proximity to amenities, and transport links significantly impact rental rates. Research comparable properties in the area to determine the average rental yield.

Next, consider the property’s features and condition. Modern fixtures, a well-maintained exterior, and additional amenities like a gym or pool can command higher rents. After estimating the monthly rent based on these factors, multiply it by the expected occupancy rate—the percentage of time the property is likely to be rented out each year. This gives you an estimate of the annual rental income. Finally, divide this figure by the property’s purchase price (plus any associated costs) to calculate the yield—a key metric in evaluating the potential profitability of buying a second property in Singapore.

Analyzing Market Trends: When to Buy and When to Wait

When considering a second property purchase in Singapore, understanding market trends is vital. Keeping a close eye on rental yields and property prices allows investors to time their purchases optimally. The Singapore real estate market can be dynamic, with fluctuations influenced by various economic factors, making it crucial to stay informed. By analyzing historical data and current market conditions, potential buyers can identify periods when rental returns are favorable and property values are relatively more accessible.

For instance, certain neighborhoods in Singapore might experience a surge in rental demand due to upcoming developments or changing demographics. These trends can signal a window of opportunity for investors who act swiftly. Conversely, waiting during economic downturns or when market sentiment is uncertain could be beneficial as prices may adjust, offering buyers a chance to secure properties at more affordable rates.

Case Studies: Successful Second Home Investments in Singapore

In Singapore, buying a second property has proven to be a lucrative strategy for many investors. Case studies highlight successful second home investments across various neighborhoods. For instance, in the vibrant and bustling Central Business District (CBD), high rental yields have been achieved through purchasing smaller apartments or condominiums. These properties cater to young professionals and expats, ensuring steady demand and high occupancy rates.

Another notable example is the growing popularity of investing in HDB flats in suburban areas like Ang Mo Kio or Sengkang. These properties offer substantial rental income due to their affordability and proximity to local amenities. Investors have successfully navigated the market by identifying undervalued areas with strong community sentiments, resulting in higher rents and faster occupancy times. Such case studies demonstrate that with thorough analysis and strategic choices, buying a second property in Singapore can be a game-changer for investors seeking lucrative rental yields.

Legal and Financial Considerations for Foreign Investors

When considering buying a second property in Singapore, foreign investors must navigate a landscape with specific legal and financial considerations. Singapore’s robust legal framework provides a secure environment for property investment, but understanding the regulations is crucial. Foreigners are subject to different rules regarding ownership rights, land use restrictions, and tax obligations compared to local residents.

One key aspect is the approval process. Non-Singaporean citizens typically require the approval of the Urban Redevelopment Authority (URA) to purchase a property. Additionally, investors must comply with foreign exchange regulations and may face capital gains taxes on property sales. It’s essential to consult legal experts and financial advisors who specialize in cross-border investments to ensure adherence to these guidelines, thereby optimizing rental yields and mitigating potential risks.

Strategies for Maximizing Rental Yield and Property Value

Maximizing rental yield and property value is key for anyone looking to invest in a second property in Singapore. One effective strategy is to focus on high-demand areas, such as central business districts or popular residential neighborhoods, where tenants are more willing to pay premium rents. This demand often translates to higher occupancy rates and better capital appreciation over time.

Another crucial approach is to maintain and update the property regularly. Regular maintenance ensures your second property remains attractive to potential tenants, while strategic renovations can add significant value. Consider modernizing amenities, improving aesthetics, or adding features that cater to contemporary lifestyles. This not only increases rental income but also prepares the property for future sales at a potentially higher price point.

When considering a buying second property in Singapore, a thorough understanding of rental yields is paramount. By factoring in market trends, legal considerations, and strategies for maximizing returns, investors can make informed decisions that tap into the vibrant property landscape. This guide equips readers with the knowledge to navigate the complexities, ensuring they are well-prepared to thrive in Singapore’s dynamic real estate arena.