Investing in a second property in Singapore can be a strategic move for wealth accumulation, with real estate often proving to be a stable and profitable venture. The market is characterized by economic growth, regulated supply and demand dynamics, and a robust rental market driven by a diverse population and expatriates. Prospective investors should consider factors such as location, proximity to business hubs, and accessibility to amenities and public transport when looking for properties with strong capital appreciation and rental yield potential. Securing the right financing through options like the Residential Property Loan or Commercial Real Estate Investment Loan is vital, and engaging a mortgage broker can help navigate the diverse loan products available. Effective property management and regular maintenance are critical for maintaining the desirability and market value of your investment, ensuring long-term success in Singapore's competitive real estate landscape. Additionally, investors should be aware of the legal framework and engage legal advisors to ensure compliance with regulations when buying a second property in Singapore.

Considering an investment in real estate within Singapore’s dynamic market? Buying a second property here can be a strategic move for wealth accumulation. This article navigates through the essential steps of assessing market trends, financial readiness, and legal requirements, particularly for non-Singaporean investors. From understanding the nuances of property ownership to selecting a location ripe for growth, and managing finances with informed mortgage choices, each section provides clarity on how to capitalize on Singapore’s real estate potential. Investors will also delve into the prospects of capital appreciation and rental yields, ensuring their second property is a sound investment. Let’s explore the path to building wealth through smart second-property investments in Singapore.

- Understanding the Singapore Property Market: A Primer for Investors

- Assessing Your Financial Health for a Second Property Investment

- Legal Considerations and Ownership Rules for Non-Singaporeans

- Strategic Location Selection: Maximizing Potential in Singapore's Real Estate

- Financing Your Second Property: Options and Tips for Securing a Mortgage

- Capital Appreciation and Rental Yields: Prospects for Your Second Property Investment

- Property Management and Maintenance: Ensuring Long-Term Success with Your Investment

Understanding the Singapore Property Market: A Primer for Investors

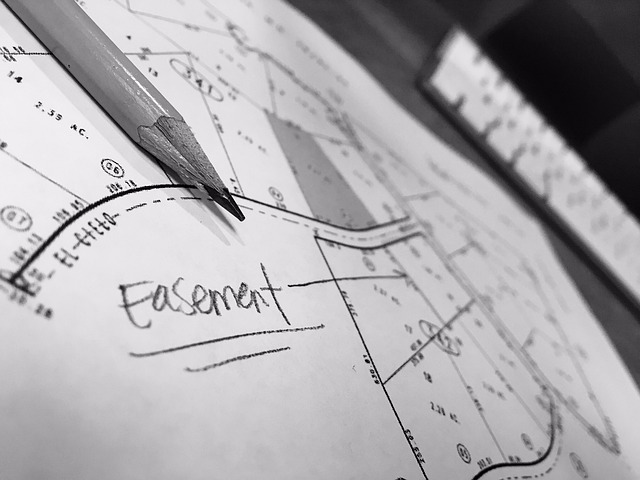

Navigating the Singapore property market is a strategic endeavor for those looking to expand their investment portfolio, particularly when considering the purchase of a second property. Prospective investors must first comprehend the unique characteristics and rules governing real estate in Singapore. The city-state’s property market is known for its robustness and resilience, underpinned by a stable economy and a population that is expected to grow over time. When buying a second property here, one must be aware of the Additional Buyer’s Stamp Duty (ABSD) and the Total Debt Servicing Ratio (TDSR) regulations, which are designed to curb speculative behavior and ensure financial prudence among property owners.

To successfully invest in a second property within Singapore, it is crucial to conduct thorough research and due diligence. This includes understanding the different types of properties available—residential, commercial, or industrial—and their respective market trends. The location, property type, and condition are key factors that influence the potential for capital appreciation. Furthermore, investors should stay abreast of government policies and economic indicators that can affect property prices and rental yields. By gaining a comprehensive understanding of these elements, investors can make informed decisions that align with their long-term wealth-building objectives when buying a second property in Singapore.

Assessing Your Financial Health for a Second Property Investment

When contemplating the acquisition of a second property in Singapore as an investment, it is imperative to conduct a thorough assessment of your financial health. This due diligence involves scrutinizing your current income streams, existing debts, and overall financial commitments. A prudent investor should have a clear understanding of their cash flow, ensuring that the monthly obligations related to both primary and secondary properties are manageable within their budget. Additionally, it is advisable to review your credit score and financial history, as these factors can influence the loan terms offered by financial institutions in Singapore.

Investors must also consider the long-term implications of owning multiple properties. This includes the potential for rental income from the second property, which can contribute to offsetting mortgage repayments or provide a passive income stream. Furthermore, one should evaluate the property market trends in Singapore, as the demand for real estate and economic conditions can significantly impact property values and investment returns. By aligning your financial health with strategic planning, buying a second property in Singapore can be a sound investment that diversifies your wealth portfolio while navigating the dynamic real estate landscape of this vibrant city-state.

Legal Considerations and Ownership Rules for Non-Singaporeans

Navigating the legal landscape of buying a second property in Singapore as a non-Singaporean citizen involves understanding the country’s strict property ownership rules. Non-residents are generally allowed to own and purchase residential properties with certain conditions. The Singapore Land Authority (SLA) oversees applications for the acquisition of residential property by foreigners, which must be submitted along with a cash deposit of at least 25% of the purchase price. Additionally, such properties are typically restricted to one per Singaporean household. This regulation is designed to maintain housing affordability and availability for locals.

Moreover, foreign buyers should be aware that they cannot purchase landed property such as terraced or detached houses, bungalows, or executive condominiums (ECs) within the first five years of their introduction into the market. Instead, they are limited to condominium units. The legal framework governing these transactions is stringent, with penalties including forfeiture of the purchase price and the right to purchase for a specified duration if rules are violated. It is crucial for non-Singaporeans considering investing in a second property in Singapore to engage with local real estate experts and legal advisors to navigate these regulations effectively and to ensure compliance with all applicable laws.

Strategic Location Selection: Maximizing Potential in Singapore's Real Estate

Investing in a second property in Singapore can be a strategic move towards building wealth, with real estate often serving as a stable and lucrative investment. A key element to this strategy is the meticulous selection of a property’s location. In Singapore, where land is scarce and demand is high, the value of a property is heavily influenced by its location. Proximity to business districts like the Central Business District (CBD) or regional centers can significantly enhance rental yields due to the premium tenants are willing to pay for convenience. Additionally, properties situated near amenities such as reputable schools, healthcare facilities, and transport nodes stand a higher chance of appreciating in value over time. Furthermore, understanding the nuances of different neighborhoods, including their future development plans, can provide insights into areas with untapped potential. Buyers should also consider the livability factors that appeal to renters or future buyers, such as accessibility, community amenities, and local infrastructure projects. By focusing on locations that demonstrate robust economic growth and are supported by comprehensive public transportation networks, investors can maximize their potential for wealth creation through a well-placed second property in Singapore’s vibrant real estate market.

Financing Your Second Property: Options and Tips for Securing a Mortgage

When contemplating the acquisition of a second property in Singapore, securing financing is a pivotal step that requires strategic planning. Prospective investors have several mortgage options tailored to their financial profile and property investment goals. One popular route is the Residential Property Loan (RPL), which caters to individual borrowers looking to purchase additional residential properties. Another option is the Commercial Real Estate Investment Loan (CREIL), designed for those investing in commercial properties or mixed-use developments.

To navigate the mortgage landscape effectively, consider leveraging the services of a seasoned mortgage broker who can guide you through the various loan packages available from banks and financial institutions. These professionals are adept at assessing your financial situation and matching it with the most suitable loan product. For instance, if you already own property in Singapore and possess a stable income, you might qualify for more favorable loan-to-value (LTV) ratios, allowing you to borrow against the value of your existing properties. Additionally, taking into account current economic conditions and interest rate trends can be crucial in optimizing your mortgage repayment schedule and minimizing long-term financial commitments. Always ensure that your monthly obligations remain manageable within your cash flow, and avoid overextending yourself, even with favorable financing options for buying a second property in Singapore.

Capital Appreciation and Rental Yields: Prospects for Your Second Property Investment

Buying a second property in Singapore can be a strategic move for wealth accumulation, with potential benefits from both capital appreciation and rental yields. Capital appreciation refers to the increase in the value of the property over time, which is influenced by factors such as economic growth, supply and demand dynamics, and real estate market trends within Singapore’s tightly regulated environment. The island-nation’s reputation as a safe haven for investments often leads to stable or increasing property values, making it an attractive proposition for long-term gains.

In addition to capital appreciation, savvy investors also consider the rental yields that a second property can generate. Rental yields are the annual rental income relative to the cost of the property. In Singapore, the rental market is robust, with a diverse population and continuous influx of expatriates requiring housing solutions. This demand can translate into consistent rental income for investors, augmenting the financial benefits of holding a second property. It’s crucial to conduct thorough research and analyze historical data on rental yields in the specific area you’re considering for your investment. Factors such as proximity to business districts, local amenities, and transportation links can significantly influence rental potential. By carefully weighing these aspects, investors can make informed decisions to optimize both their capital appreciation and rental yield prospects when buying a second property in Singapore.

Property Management and Maintenance: Ensuring Long-Term Success with Your Investment

Navigating the Singapore property market to purchase a second property can be a strategic move for wealth accumulation, especially when considering property management and maintenance as key components for long-term success. Effective property management is not merely about renting out your second property; it encompasses a comprehensive approach that includes tenant selection, financial oversight, and compliance with local regulations. In Singapore, where real estate is a coveted investment, maintaining a well-managed property can significantly enhance its value over time. Regular maintenance is pivotal; it ensures the property remains in top condition, thereby preserving its appeal to both tenants and potential buyers should you decide to sell in the future. Engaging a reliable property management firm or hiring a competent property manager can alleviate the burdens of day-to-day upkeep, allowing for peace of mind and the freedom to focus on your broader investment portfolio. Moreover, proactive maintenance can prevent costly repairs down the line, safeguarding your financial interests and contributing to a steady stream of rental income from your second property in Singapore.

When considering the expansion of your investment portfolio through real estate, Buying a Second Property In Singapore emerges as a strategic move within a mature and regulated market. By meticulously evaluating your financial position, understanding the nuances of local property laws for non-Singaporeans, and selecting properties in advantageous locations, you can capitalize on both capital appreciation and robust rental yields. Securing financing tailored to your unique situation is also paramount. Ultimately, maintaining a well-managed and maintained property portfolio is key to sustaining the wealth you build over time. With careful planning and due diligence, a second property in Singapore can be a lucrative addition to your investment strategy.